What Business Expenses Are Deductible are the perfect option for remaining arranged and handling your time efficiently. These calendars can be found in a variety of formats, consisting of monthly, weekly, and yearly designs, allowing you to choose the one that fits your planning style. Whether you're tracking consultations, setting goals, or handling your household's schedule, a printable calendar is a simple yet effective tool. With adjustable styles varying from minimalistic to lively styles, there's a choice to fit everyone's taste.

Downloading and printing a calendar is quick and hassle-free. You can print them in your home, work, or a local store, making them available anytime you require them. Lots of templates even include pre-marked vacations and special celebrations, saving you time. Start preparing your days with a What Business Expenses Are Deductible and delight in the advantages of a more organized and productive life!

What Business Expenses Are Deductible

What Business Expenses Are Deductible

Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Give Form W 4 to your employer Your withholding is subject Download and print blank W-4 Withholding Forms so that your employer can withhold the correct federal and/or state income tax from your pay.

Forms instructions and publications Internal Revenue Service

Business Meals 50 Deduction 100 Percent Deduction Tax Planning For

What Business Expenses Are DeductibleThis certificate is for income tax withholding and child support enforcement purposes only. Type or print. Notice to Employer: Within 20 days of hiring a new ... Information about Form W 4 Employee s Withholding Certificate including recent updates related forms and instructions on how to file

However, this form can also be completed and submitted to a payor if an agreement was made to voluntarily withhold. Illinois Income tax from other (non-wage). Nondeductible Expenses Meaning List FAQs Shoeboxed Tax Deductible Definition Expenses Examples

Blank W 4 withholding forms Symmetry Software

Qbi Phase Out 2024 Sellers Vintage Brunofuga adv br

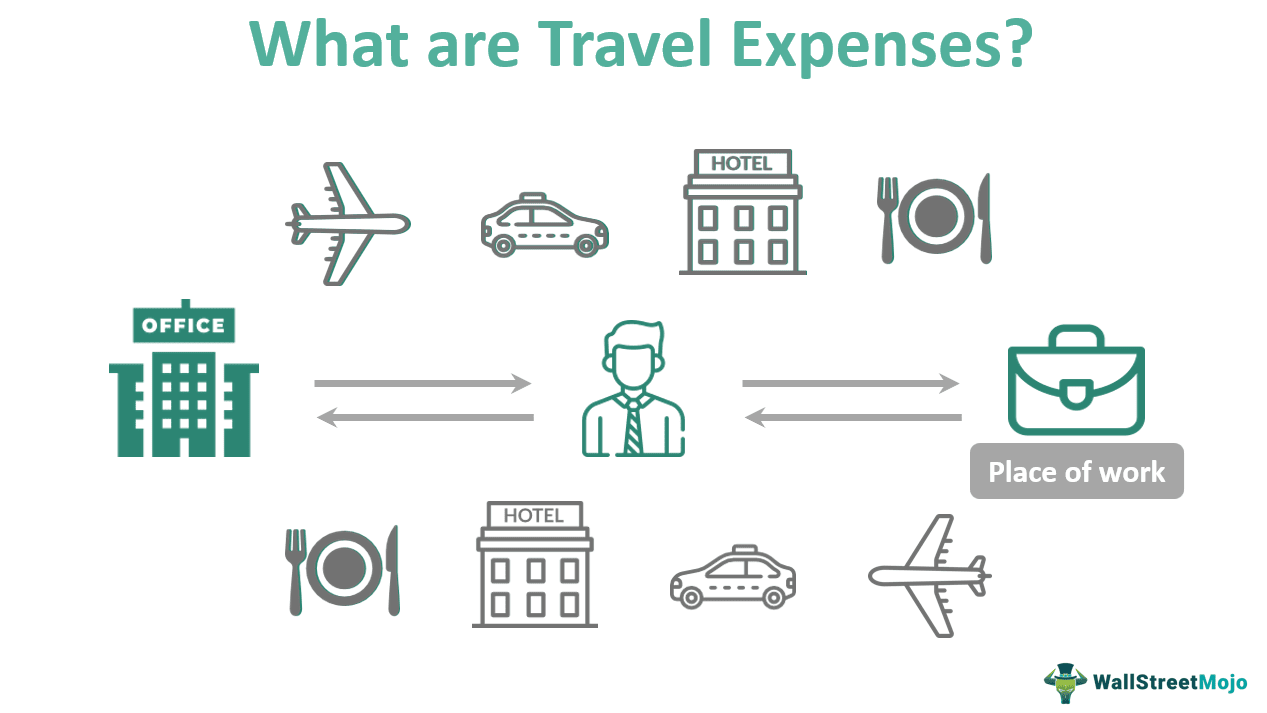

Allowances claimed on the Form W 4N are used by your employer or payor to determine the Nebraska state income tax withheld from your wages pension or annuity Travel Expenses Definition Business Examples Reimbursement

Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay If too little is withheld you will generally owe tax when Are Business Trip Expenses Tax Deductible Infoupdate Itemized Deduction Definition TaxEDU Glossary

CSK Did You Know RMC No 81 2025 Clarifies That Only Expenses

2024 Medicare Deductibles Copays Telos Actuarial

Small Business Categories List With Examples BEST FURNITURE IDEAS

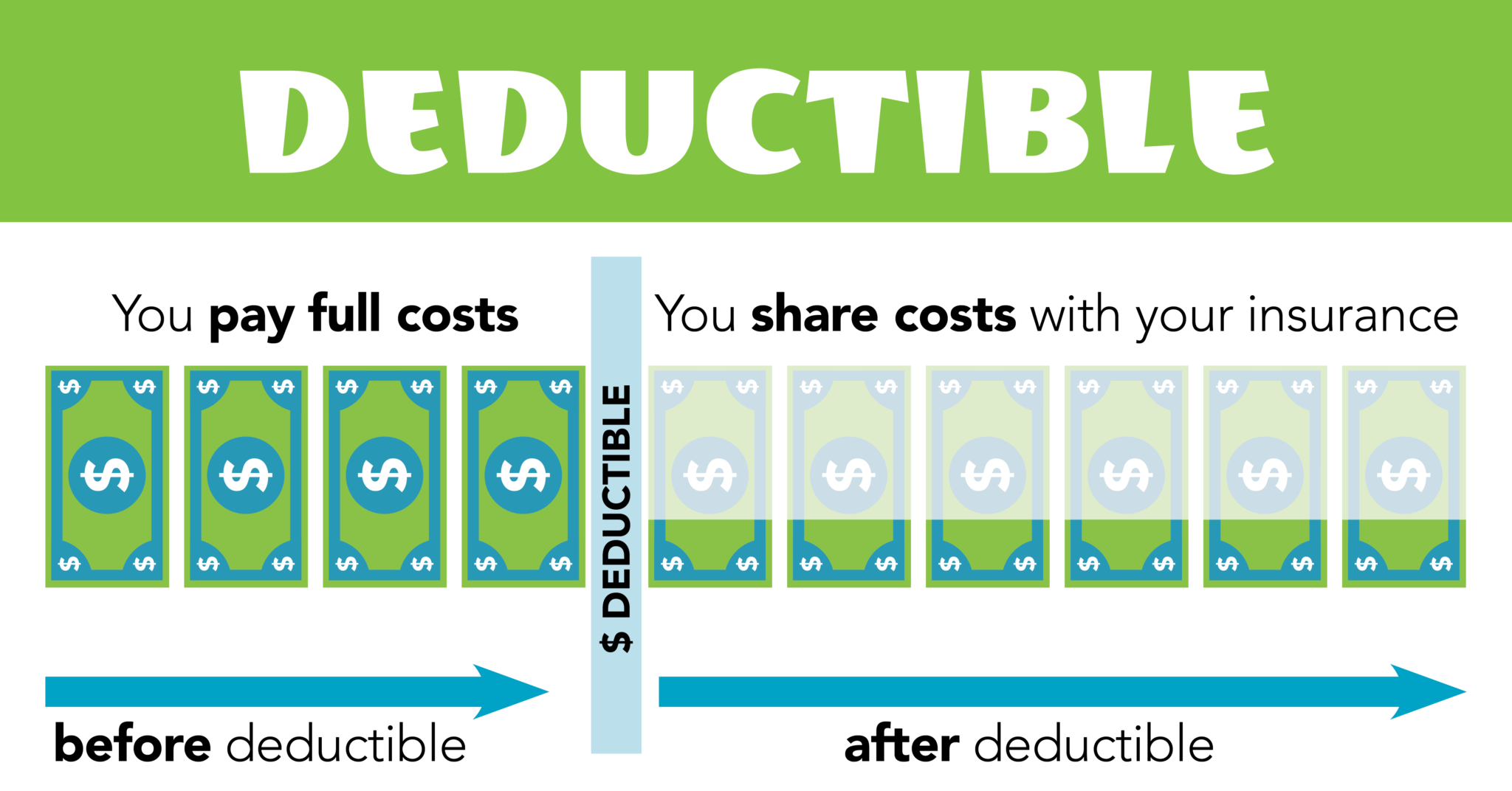

Deductibles Explained ETrustedAdvisor

Free Tax Write Offs Templates For Google Sheets And Microsoft Excel

Are You Unsure What Expenses Are Deductible For You Business This

Small Business Tax Deductions Worksheet

Travel Expenses Definition Business Examples Reimbursement

Tax Resolution Templates Prntbl concejomunicipaldechinu gov co

Business Expenses