Customs Appellate Tribunal Rules are the ideal service for remaining organized and managing your time successfully. These calendars are available in a variety of formats, including monthly, weekly, and yearly layouts, enabling you to select the one that fits your preparation style. Whether you're tracking consultations, setting goals, or handling your family's schedule, a printable calendar is a basic yet effective tool. With customizable styles ranging from minimalistic to dynamic themes, there's an option to suit everyone's taste.

Downloading and printing a calendar is quick and problem-free. You can print them in your home, work, or a local shop, making them accessible anytime you require them. Numerous templates even include pre-marked holidays and unique occasions, conserving you time. Start preparing your days with a Customs Appellate Tribunal Rules and delight in the advantages of a more organized and productive life!

Customs Appellate Tribunal Rules

Customs Appellate Tribunal Rules

A bill of sale is a legal document that transfers ownership from a seller to a buyer in exchange for trade INSTRUCTIONS: 1. Seller of motor vehicle or vessel must complete, sign and give this form to the purchaser. Seller should maintain copy for records.

Form 1957 Missouri Department of Revenue

CUSTOMS EXCISE SERVICE TAX APPELLATE TRIBUNAL 1st

Customs Appellate Tribunal RulesA motor vehicle bill of sale is between a buyer and a seller of a car, truck, or motorcycle. It is signed as the last step in the sales process. Clearly print or type all information except signatures MV 912 11 21 DESCRIPTION OF VEHICLE TERMS AND CONDITIONS if applicable Year Make Model

This Bill of Sale was provided by me. Under pains of penalties of perjury, I declare that the statements herein contained are true and correct to the best ... CESTAT Rules Set Off Of Excess Duty Payments Permissible Against Short CESTAT Weekly Round Up

Bill of Sale CT gov

Relief For Thermax After Customs Appellate Tribunal Sets Aside Rs 1 381

Use this form to gather necessary information when you sell your vehicle or vessel Completing this form does not transfer the title or act as a Report of CEVT Exam Question Solution 2023

I We do vouch to be the true and lawful owner s of said vehicle the same is free and clear of all liens and encumbrances and that I We have full Ministry Of Finance On Twitter The Inaugural Function To Commemorate Central Government Notifies Appointment Of 7 Judicial Members To CESTAT

Customs Excise Service Tax Appellate Tribunal CESTAT Recruitment

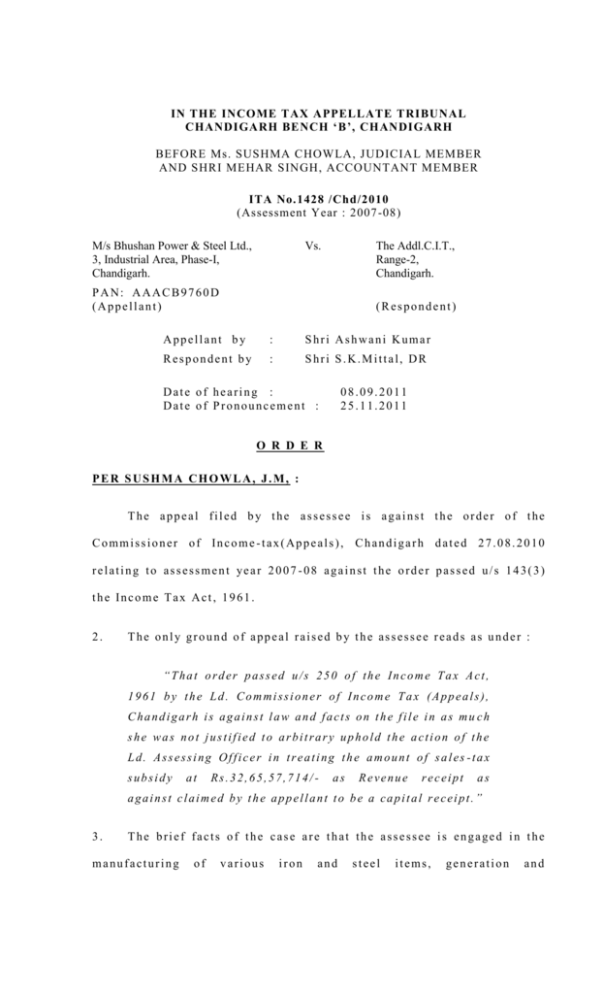

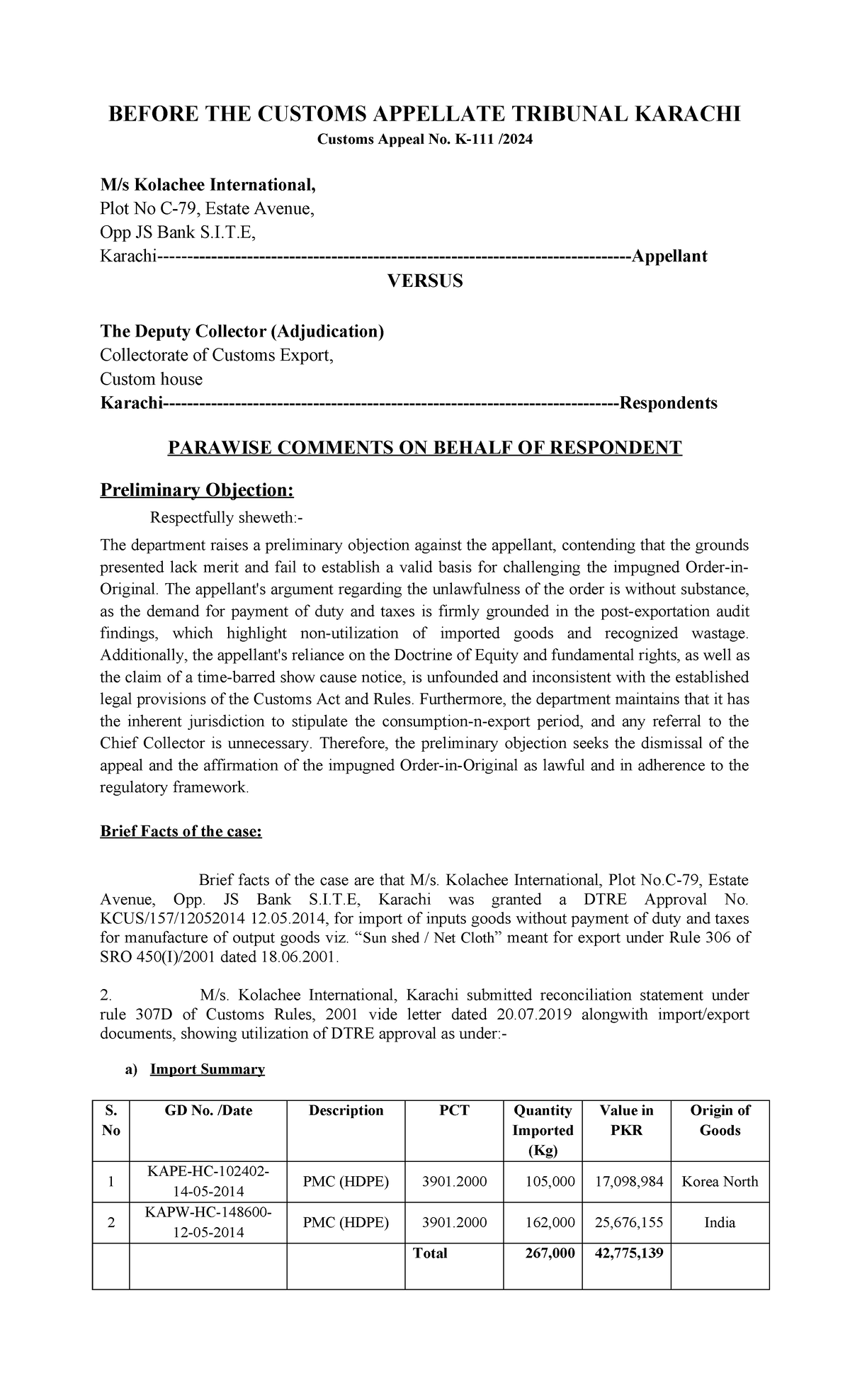

Kolachee Tribunal Pwc A Written Statement BEFORE THE CUSTOMS

Dawn On Twitter A Customs Appellate Tribunal Has Held That The

Customs Excise And Service Tax Appellate Tribunal CESTAT To

Ministry Of Law And Justice

Ministry Of Law And Justice

Builder Eligible For Service Tax Refund On Cancellation Of Booking By

CEVT Exam Question Solution 2023

No Service Tax Under Manpower Recruitment And Supply Agency Services

Ocean Freight Markup Not Subject To Service Tax CESTAT