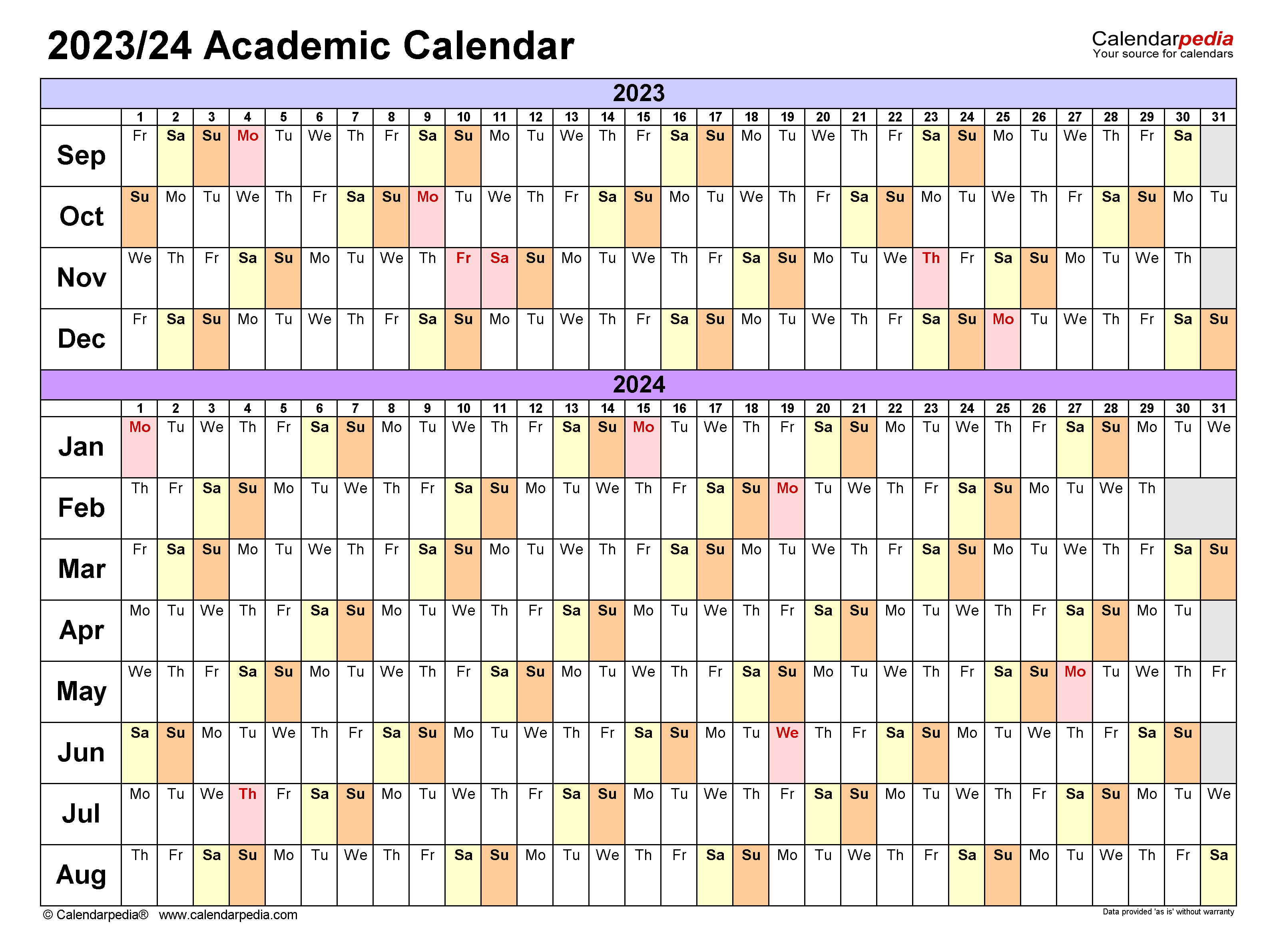

Uw Platteville Calendar 24 25 are the ideal solution for remaining organized and handling your time efficiently. These calendars can be found in a range of formats, including monthly, weekly, and yearly designs, permitting you to pick the one that fits your planning design. Whether you're tracking consultations, setting goals, or handling your household's schedule, a printable calendar is an easy yet effective tool. With customizable styles varying from minimalistic to vibrant themes, there's an option to fit everyone's taste.

Downloading and printing a calendar fasts and problem-free. You can print them in your home, work, or a regional shop, making them accessible anytime you require them. Lots of templates even consist of pre-marked holidays and special occasions, conserving you time. Start planning your days with a Uw Platteville Calendar 24 25 and take pleasure in the advantages of a more organized and productive life!

Uw Platteville Calendar 24 25

Uw Platteville Calendar 24 25

Free printable crossword puzzles 7 new puzzles every day Our crossword puzzles are updated every month. Crosswords - December 2024. Crosswords – December 2024. Crosswords - November 2024.

Daily crossword puzzles free from The Washington Post

[img_title-2]

Uw Platteville Calendar 24 25Our collection of free printable crossoword puzzles for kids make fun and easy learning games for beginners of all ages. We cover a variety of academic ... We hope you enjoy this collection of free NOVEMBER large print puzzles Each crossword puzzle PDF file includes a puzzle grid one or two definitions pages

Free crosswords that can be completed online by mobile, tablet and desktop, and are printable. Daily easy, quick and cryptic crosswords puzzles. [img_title-17] [img_title-16]

Printable Crossword Puzzles Senior Living Media

[img_title-3]

FREE and No registration needed Free A I Generation Add images change colors and fonts to create professional looking printable crossword puzzles [img_title-11]

Your free daily crossword puzzles from the Los Angeles Times Follow the clues and attempt to fill in all the puzzle s squares [img_title-12] [img_title-13]

[img_title-4]

[img_title-5]

[img_title-6]

[img_title-7]

[img_title-8]

[img_title-9]

[img_title-10]

[img_title-11]

[img_title-14]

[img_title-15]